Sum does some brain storming to prepare a few mosaic Quiz Questions. Try how many you can answer (Answer them by leaving a comment and leave your email address to know the correct answers)

Quiz1: Name the airline that used a famous Belgian Statue of a

urinating child in one of its advertisement and used the words “pissed off high

fares?” to play a spoof on one of its competitor's high fares.

Quiz2: Which head of an airline served in full cabin crew uniform

as a flight attendent on a competitor airline’s flight after losing a bet on

F1?

Quiz3: Which English word meaning "the faculty of making

fortunate discoveries by accident" is derived from the name of an island

in the Indian

Ocean ? How is it derived?

Quiz4: Name any other city that you can create by shuffling the

letters in TOKYO

Quiz5: Adnan Nevic, born on Oct 12, 1999 in Sarajevo , Bosnia

Quiz6: Which famous company derive its name from the last letters

of the city that inspired it.

Quiz7: Where on the earth would you find "one hundred

thousand islands"?

Quiz8: Translate “Can’t you see this” into a Hindi idiom to name

the F1 driver who is also the brand ambassador for a hair care product.

Quiz9: Name the company. Its business model is offering a daily

discount deal, whereby the buyers/ customers buy a product or service very

cheaply if a minimum number of people sign up for the offer.

Quiz10: Which animal is reputed to have a thousand legs?

Quiz11: Which famous gun derives its name from the two cities

where it was designed and manufactured?

Quiz12: Which American Multinational recently put out an advert

seeking applicants for job vacancies? They said in the advert that ‘sexual

minorities’ (transgenders, gays, lesbians, bisexuals) would be given extra

points in the screening process. (The advert was later withdrawn due to public

uproar).

Quiz13: Which Multi-National Company is named after a type of

African antelope?

Quiz14: Name the politician. He is the mayor of a city in US and

we have a Television channel by his name in India

Quiz15: Name the politician whose teenage daughter got pregnant

when she was campaigning for a political post. She also said during campaigning

that “Russia

Quiz16: Name the famous monument in Africa that features a scantily clad man and

woman, holding a child. It’s a bronze statue built with a colossal expense of

USD 27 millions.

Quiz17: Analyze the featured pic to name the product launched in

1990 by a legendary auto company. The product uses a type of patented engine

that produces a "potato-potato” sound.

Quiz18: During which cricket match in India the crowd gave Pakistan a standing ovation after they defeated India …in India

Quiz19: Name the fruit/ vegetable which gains prominence in the

coming week. A type of beer is also brewed from this fruit/ vegetable. (Try and

explain the reason for prominence)

Quiz20: Name the concept that is used by a publishing house to

determine undervalued/ overvalued exchange rates based on an informal way of

measuring. The pic features a very important element of this measurement

concept.

Quiz21: Name the product I am referring to - Queen Victoria Leicester .

NASA exploited a myth about this product to play a spoof on April fool’s Day.

Quiz22: Combine the name of a popular Bollywood movie based on

Alzheimer's disease and the actress featured in the pic to name the company I

am referring to.

Quiz23: Which airline’s flight steward quit his job by opening the

door of a moving aircraft and jumping out through plane’s emergency chute?

Quiz24: You 'never' actually own this product, you merely look

after it for the next generation. Name the brand who claims this.

Quiz25: Name the car company, whose cars are said to have a grill

which look like a Greek Temple

Quiz26: He used the code word of India - Sri Lanka US

Quiz27: What is featured in this pic?

Quiz28: What is featured in the pic and what is this particular

place called?

Quiz28: The Economist and Harvard Business Review have carried out

separate articles on this “Hindi” word which roughly means frugal innovation.

This term is also used for a type of a vehicle in rural India

Quiz29: Which Governor of a state in US recently ordered all the

state employees to answer their phone by a particular salutation? This was done

to boost employee morale and help sell the state to outsiders. (Hint: Only a

lady can think of such a thing)

Quiz30: Name the non government organization whose logo is

featured in the pic. The organization was formed in 1961 in England

Quiz31: Name the destination featured in the pic (Hint: Its an

exotic SPA destination)

Quiz32: Name the famous animated sitcom which has a character

called Maggie? It also was awarded a star on the Hollywood wall of fame. It is also famous for

the annoyed grunt of one of its characters, “D’oh”.

Quiz33: Name the Bollywood actress who has live in Hong Kong,

China, Japan, France, Switzerland, Krakow, Berlin, Belgium, Hawaii and England

before moving to Mumbai?

Quiz34: What is common in these cities - Monaco , Melbourne , Valencia and Singapore

Quiz35: Name the auto brand which derives its name from a river in Italy Milan and England India

Quiz36: Name the car company - The world of bullfighting is a key

part of this company’s identity and it names most of its cars based on the name

of bulls

Quiz37: Name the brand whose advert featured models in the nude,

wearing only shoes and a python wrapped around them. Also name the models.

Quiz38: The nickname 'SoLoMo' given by a popular venture

capitalist refers to which three computer technologies.

Quiz39: Which international hotel chain advertisements feature

these celebrities – Lance Armstrong, Christian Louboulin and Jerry Hall (among

others)? Hint: Each featured celebrity has chosen a charity to which the hotel

chain has made a donation of USD 10,000.

Quiz40: Name the company whose proposed headquarters in US is a

ring shaped structure dubbed as spaceship.

Quiz41: Name the brand which the following tagline: ". . . .

. mixes with everything except driving".

Quiz42: Name the airline: In Mar 11, the recording of an inflight

transmission of one of its pilot's unintentional conversation with his copilot

was released to the press. The conversation had foul language and discussed

gay, overweight and older flight attendants.

Quiz43: What am I referring to when I say QE, QM, QV ? Name the

company who owns these brands. Hint: Its related to travel industry. Its also

got something to do with Monarchy.

Quiz 44: Which internet domain was launched in September and the

addresses went on sale?

Quiz 45: What is common between New York City , London , Milan and Paris

Quiz46: Name the brand associated with the following product

names:

Red, Black, Green, Gold, Blue, XR21 and King George V

Quiz47: Name the brand associated with "eternity ring",

"trilogy" ring and the "right hand ring".

Quiz48: Which airline would you be flying if you fly by

"Queen's Own Aviation Company".

Quiz49: Name the airline in which cabin crew used to sing

in-flight safety instructions (or sometimes interpret the instructions

artistically). The featured picture depicts a Television Show that promoted the

airline with a specialized concept. The airline ceases to exist now.

Quiz50: Name the country which is also referred to as the ‘eighth

continent’ because of its rich biodiversity; 80-90% of the plants and animal

species found in this country are found no where else in the world.

Quiz51: Name this fortnight long fair in which more than 7 million

liters of beer is consumed. This is the largest people’s fair in the world.

Quiz52: Name the Company that played an April fool spoof on its

subscribers wherein if anyone clicked on the company website’s main page, the

whole page turned upside down. The company claimed this was a new layout.

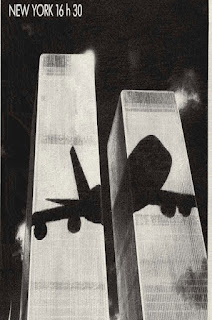

Quiz53: Name the airline whose advertisement is featured in the

pic. The advertisement appeared in the March 19th, 1979 issue of major dailies

in the west. Yes, the shadow is in pretty much in the same place as where the

planes hit on September 11th, 2001.

(I’ve cropped the pic to remove the name of the airline)

Quiz54: Name the airline. Every plane in this airline’s fleet is

named with a destination containing some part of the airline’s name. The

airline is also known for it’s “letter ads” i.e. the ads starting with

Dear….and ending with Sincerely…

Quiz55: Relate the featured image to name the NGO which is one of

the older human rights associations. It has a separate prison committee to

provide assistance to its members who have been imprisoned, tortured,

threatened, attacked, made to disappear, and killed for the peaceful practice

of their profession.

Quiz56: Name the person. He became leader of a country in 1975.

His policies and torture/ force resulted in the deaths of approximately 21

percent of the country’s population (approx 2.5 million people died under his

leadership). Gas chambers were one of the ways used by him to execute people.